- SBI

- activate atm sbi

- close sbi credit card

- close account sbi

- change number sbi

- add beneficiary sbi

- generate sbi pin

- sbi account balance

- sbi complaint status

- sbi international card

- sbi irctc card

- link aadhaar

- sbi student account

- saving plus account

- sbi saving account

- register mobile sbi

- online sbi complaint

- unblock sbi card

How to Open SBI Saving Account

SBI providing facility to open online saving account sitting at your home. Fill the all information online, take a print out, attached your document, go to the branch and collect your passbook and ATM. That's it. Here we are going to explain step by step complete guide.

Online Application For New Savings Account In State Bank Of India

SBI Saving Account Online

State Bank of India(SBI) remains the choice of each and every customer. It allows the users to create a new account wither through online or through the offline modes.

What is Eligibility Criteria for SBI Saving Account Online

- The basic savings account sets up an age limit of above 18 years with the nationality of Indian carrying the valid documents that are required by the banking personnel to open a new savings account.

- The savings account with SBI requires a balance of INR 3,000 to be maintained. Other accounts can be started with the zero balance.

Required Documents to Open SBI Saving Account Online

If you have Aadhaar card will be very easy to open SBI saving account online. or bellow ID is required.

- Address Proof

- PAN Card

- Driving License

- Passport size photograph

The customer should attach the application form, Form 60 and nomination form along with the above documents to the banking personnel.

Procedures to Open SBI Saving Account (Online)

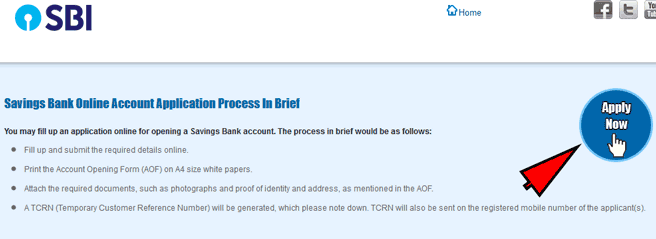

1. Using the browser visit the SBI website.  2. Select Apply online.

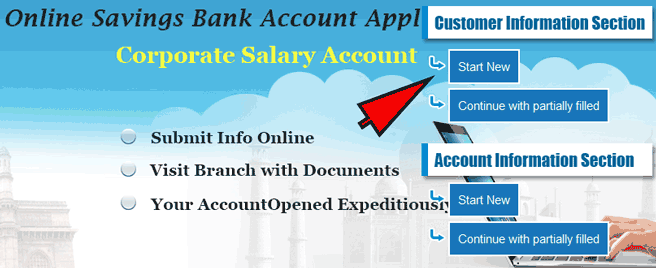

2. Select Apply online.  3. Provide the personal data that are required for creating a new account through online website.

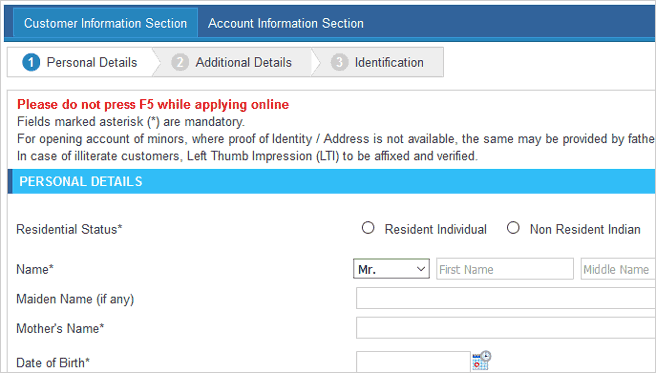

3. Provide the personal data that are required for creating a new account through online website.  4. After the creation of new account, the customer will receive a Temporary Customer Number (TCRN) through the mobile which he/she registered in the account.

4. After the creation of new account, the customer will receive a Temporary Customer Number (TCRN) through the mobile which he/she registered in the account.  5. The user should take a copy of the account opening form and move on to the branch in their locality within a period of one month with necessary documents. 6. The banking personnel will check the details and new savings account will be created.

5. The user should take a copy of the account opening form and move on to the branch in their locality within a period of one month with necessary documents. 6. The banking personnel will check the details and new savings account will be created.

Procedures to Open SBI Saving Account (Offline)

1. The customer has to visit the branch and get account opening form from the banking personnel or they can download the form online. 2. Customer should be prepared with the completed forms for savings account creation. 3. The documents are verified by the banking personnel and the account is opened.

SBI Savings Account Categories

1. Savings Plus Account with SBI

This account is associated with MOD. The amount in the account will be moved to MOD Balance in multiples of thousand rupees. Minimum Balance should be INR25,000

2. Yuva Savings Account with SBI

It is specifically for age groups 18 to 30 who opens the account for the first time.

3. Basic Savings Account with SBI

People above 18 years with valid necessary documents are allowed to open a new account. It mainly concerns the inferior people to insist the saving.

4. Small Account with SBI

Any individual above 18 years is allowed to create an account. It considers the inferior people for saving money.

5. Saving account for Minors with SBI

It offers two techniques Pehlakadam, Pehliudaan. Account is created along with parents for minor children. Minimum balance is not required. The interest rate is 4%Per annum on daily balance amount.

6. SBI Salary Account

It is used for crediting the salary. It is specifically designed for employees of government organization, Police department, and corporate. It offers Free multicity cheque, accident insurance, debit card and variety of loans.

7. SBI student Bank account

This is for the student of college will get the details of the student and submit to the bank in order to open an account.

Related Article

- How To Generate SBI ATM PIN

- How to Check SBI Account Balance

- How to Check SBI Online Complaint Status

- How to Apply SBI International Debit Card

- How to Get and Use SBI IRCTC Card

- How to Link Aadhaar Card to SBI

- How to Open SBI Student Account Online

- How to Open SBI Saving Plus Account

- How to Register Mobile Number in SBI

- How to Register SBI Complaint Online

- More Articles...